Do you have enough? When you’re considering buying your first business, this is probably the first question you will ask yourself. Why? There’s an unhelpful preconceived notion that you need millions and millions to buy a successful business. Guess what? You don’t.

Business prices can vary greatly, even within the same industry. If you are interested in buying a restaurant, for instance, you could get a small neighborhood sandwich shop for $50,000 – or you could shoot for a large waterfront steakhouse that could run you $500,000.

How are businesses priced?

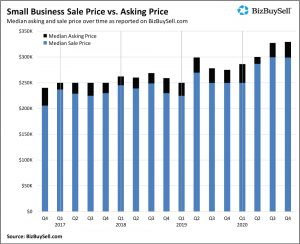

Businesses are priced based on a few factors – namely how much money they earn (cash flow), the value of things like vehicles/equipment/furnishings and the value of the current inventory. There are other factors that also play into pricing, like how much comparable businesses have recently sold for, how many years the business has been open – the list goes on. When you first enter the business market it is a great idea to use the advice of an experienced and qualified business broker because they will be able to both explain how a particular business has been priced and also advise you on whether the business is potentially worth what the sellers are asking.

How do I actually buy a business?

In the business world cash is king. Most first-time buyers, however, are not coming to the market with large amounts of cash to spend. If you don’t have a ton of cash available then a very large manufacturing business that lists in the millions is probably not for you. There are, however, smaller businesses that can run under $30,000. What you end up spending will depend on what type and size of business would fit with your goals and also what you can afford.

What if I have almost no cash available, can’t I just get financing? Yes and no. Buying a business is nothing like buying a car. You can’t walk in with no money down and walk out with the keys. There are a few financing options available to business buyers, but it is important to understand from the start that you will need a fair down payment for any business with any financing option. No one is going to finance 100% of a business purchase.

There are a few traditional lending options – like bank loans – but for the most part you will have an incredibly hard time getting any bank to finance a small business purchase.

The Small Business Administration (SBA) has some funding available, but much like traditional lending these loans are often hard to get. A business must meet a rather stringent set of criteria and then the buyer themselves will also have to meet SBA’s buyer criteria.

The last and most common financing option is something called seller financing. In this scenario the seller finances a portion of the purchase price to be paid back by the buyer over time. If you are looking to this option then you as a buyer will have to bring some capital to the table in the form of a down payment. For a seller a large down payment shows good faith that a buyer is serious about getting to a closing table. For buyers, a seller who is willing to hold a note like this is a good sign. It means the seller has confidence in the future of the business.

No matter how you end up buying a business – be it cash or financing – the most important point is to have realistic expectations and seek some sound advice.

When you first talk to your business broker, be honest about the amount of capital you will actually be able to bring to the table. Dishonesty here will eventually come out as you will be asked to prove how much capital you have as a deal progresses. Also be honest with your broker about what you are looking to get out of buying a business – if you just want to be your own boss, if you want a flexible schedule or if you want to follow a passion you’ve always had. With the amount of money you have and the goals you have in mind an experienced broker should be able to find you businesses that will meet with both what you have and what you need.

Are you a first-time buyer who has more questions about how businesses are priced? Would you like to know how much of a down payment you would need? Please ask us! Leave a question here, and we would be happy to help.

Michael Monnot

941.518.7138

Mike@InfinityBusinessBrokers.com

5111 Ocean Boulevard, Suite E

Siesta Key, FL 34242

www.InfinityBusinessBrokers.com