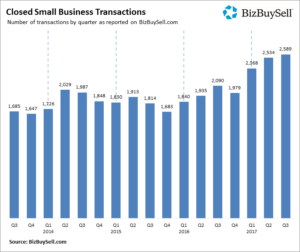

The small business market is booming, record setting booming, with this year on pace to see the highest number of small businesses bought and sold in the last decade.

Closed transactions are up 24% from the same time last year and small businesses are performing well, which may be a contributing factor to the increased numbers of sales and the higher sales prices. Median revenue of sold businesses is up 11.2 percent from the third quarter of last year, and the number of active listings is up 6.7% over last year. This increase of options means better choices for buyers looking to enter the world of business ownership.

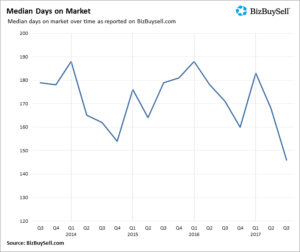

Not only are businesses selling for higher prices, they’re selling faster too. The median time to closing fell 14.6% from last year – an average of only 146 days. This might mean that the confidence of buyers in the small business market and the motivation of sellers to sell while the market is good are coming together over the negotiating table.

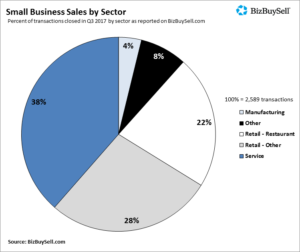

The hottest industry sector? Service. Restaurants, in particular, saw a 22.2% increase in median revenue for those businesses that sold in the third quarter. The number of service industry transactions was also up – 26% when compared to last year.

What could be driving these impressive market gains? The economy is doing well in general, so small businesses are seeing good numbers. This coupled with the possibility of fewer regulations and a decrease in taxes could be giving the market a push.

What does this mean for you? Sell while the selling is good. The factors contributing to this booming small business market – like the possibility of tax reforms and the raging economy – may falter and affect what you can get for your business if you wait to list. A boom is always followed by a bust, so get the biggest return on your business investment by riding the wave at the top – not the bottom.

Want to know what businesses like yours are currently selling for? Contact us today.

Michael Monnot

941.518.7138

Mike@InfinityBusinessBrokers.com

12995 South Cleveland Avenue, Suite 249

Fort Myers, FL 33907