It is a very common complaint in the world of business sales. A buyer comes to the market with money in hand and ready to buy the right business – but every time they request financial documentation what they get is poorly assembled numbers, difficult to understand tax returns and no current financials of any kind.

Do they want to sell their business or not?

What you have to remember about the small business world is owning your own business is a tough and time-intensive enterprise. Small business owners are great at what they do, but most are not trained accountants. Many times record keeping and financial documentation fall down the priority list, and what a buyer is left with is what the seller was able put together in the short time the business has been listed.

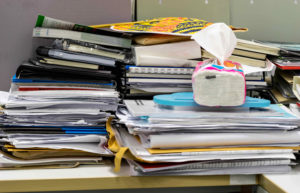

When we take on a listing for a small business we often get handed nothing more than a big box of crumpled papers and register tapes – and have to figure out the numbers from there. This is not true of all small businesses, as some owners are better record keepers than others – but you have to remember that even a great business may not have the world’s most organized books.

It is also typically true that the larger the business is, the more likely it is that they have an accountant on payroll and therefore the more complete the records will be – but if you are in the market for a small business you probably don’t have the couple of million dollars you would need to buy one of these higher-priced and more-complete-records businesses.

What should I do then? How can I decide with seemingly incomplete records?

Have patience, and understand that you will never get perfectly organized books. What you will get is the opportunity to look at all of the financial records of a business once you have entered the due diligence phase. Your business broker will be there to help you, and if the books really are a mess then perhaps an accountant familiar with business transactions will be brought in.

What you can do as a buyer is use that not-so-pretty cursory information you get with your first requests – like P&L statements and tax returns – to weed out businesses that don’t suit you and focus a more thorough look on on the ones that do.

Are you in the market to buy a business, but are disappointed with the information you’ve been sent so far? Would you like to know more about how we as brokers turn that jumbled box of paperwork into use-able numbers? Please feel free to leave any questions or comments here, we would be happy to help.

Michael Monnot

941.518.7138

Mike@InfinityBusinessBrokers.com

12995 South Cleveland Avenue, Suite 249

Fort Myers, FL 33907

www.InfinityBusinessBrokers.com

Leave a Reply