The Pre-Closing Panic: How Business Buyers And Sellers Can Avoid Disaster

Posted in Buyers Articles, Sellers Articles

A business changing hands is a big deal. One side is selling their blood, sweat and tears. The other is writing a very big check and stepping into the unknown. It can be scary. Really scary.

What happens more often than not is one or both sides start to panic as the closing date approaches – and when that happens tempers can flare and perfectly good deals can fall apart.

How do you avoid a pre-closing disaster? Know that it’s coming and mentally prepare.

Sellers:

If you are selling your business, it can be difficult to remain objective and unoffended when a buyer gets antsy and starts questioning everything about your business. We get that. Repeat questions, constant requests for renegotiation, attempts to lower the offer, demands for new issues that have already been dealt with and the like would make anyone angry – even angry enough to pull out of the deal.

What you should know going in is these things are probably going to happen. There are very few buyers who don’t get cold feet as the contract winds towards closing, and those cold feet can cause a buyer to do some pretty weird things. They are going to try to find a way to back out of the deal – not because they really want to, but because their nerves got the better of them.

Whatever your buyer is doing or demanding at the end, take a step back and think about where the panic behavior is coming from. Are they just freaking out? Have they really found an insurmountable issue with your business, or are they trying to give themselves a reason to back out because they’re scared? You don’t have to bend to their every demand, but you do need to have some patience and be ready for this inevitable last-minute buyer anxiety.

Buyers:

If you are a buyer, know going in that you are probably going to be really nervous – increasingly so as the date for writing that big check approaches.

You are absolutely entitled to all of the information you need before you sign on the dotted line and buy a business – that’s what the due diligence period is for. You need to utilize that time for due diligence to go through all of the information you request, ask good questions, discuss any issues you uncover with your business broker, your spouse, your transaction attorney, etc. and make an educated decision based on all of that information. Once you’ve made that decision – don’t second guess yourself.

Feeling anxious about a big decision is totally normal – letting that anxiety override an educated decision is far from productive. If you are days away from closing and are feeling like you’re making a mistake – go back and talk to the people you talked to during the due diligence process, like your business broker, your spouse and your transaction attorney. Go over your worries and work through why you are suddenly feeling like you don’t want to go through with the deal. It is nerves, or is it really an insurmountable problem? If you’ve made it all the way through due diligence without finding a deal-killing problem, it’s probably just nerves. Don’t talk yourself out of a great new opportunity.

The message? It’s the last minute panic that causes the issues. Big decisions might feel like they require a big leap of faith – but the reality is the decisions you’ve made during your business transaction have been made based on facts, no leap of faith was required. Trust your gut, be patient with the other side and remember that nerves can only cause issues if you let them.

Do you have questions about how to deal with a panicking buyer? Would you like to know more about how due diligence works? Ask us! Leave any questions or comments and we would be happy to help.

Michael Monnot

941.518.7138

Mike@InfinityBusinessBrokers.com

5111 Ocean Boulevard, Suite E

Siesta Key, FL 34242

www.InfinityBusinessBrokers.com

No Comments »

Don’t Lock The Doors – Sell Your Distressed Business Instead

Posted in Sellers Articles

We see this way more often than we should.

A business owner, for any one of a myriad of reasons, decides that the time has come to step away from their role as the owner of their business. Perhaps they’ve decided it’s time to retire, maybe they were hoping to pass the business on to children who have decided to follow another path or perhaps they are in the midst of a personal/family emergency that will require too much of their time and energy to keep the business afloat. In today’s market it might be because the pandemic has caused a massive hit to their bottom line and they don’t see a path forward.

Here’s the problem – the only solution they see is to sell some physical assets, lock the doors and walk away.

This isn’t the only choice. Existing businesses are worth far more than just the value of the tangible assets because an existing business has (or has recently had) cash flow.

Cash flow has it’s own value and is a highly sought-after commodity, especially if your business is in a soon to be healthy market and has the potential for growth.

Ok, so cash flow has value – but who would want to buy my business?

Lots of people would. Budding entrepreneurs who want a safer bet than starting from scratch, veteran business owners who want a change of pace and are looking for businesses with room to grow, foreign investors who are looking to move to the United States by buying a business – just to name a few.

Think of it this way – someone who wants to own their own business has two options. They can make a very risky and very large monetary investment in an unproven location, with an unproven business model and unproven products and services – or they can buy a business who has already overcome those initial hurdles. A buyer knows your location, business model, products and services worked because your doors are open and your books show growth (or have shown growth in the time period before the pandemic hit). They get an operating business from day one instead of a risk-filled empty space, and you get a financial return on all you have invested in your business.

If you don’t really have a plan for your exit as the owner of your business, it might be a good idea to talk to a business broker about what options you may have, what kind of timetable you are considering and what businesses like yours have recently sold for. Asking questions now will give you the information you need to make the smart choice – the choice to sell your business when the time is right. Don’t walk away and leave so much on the table, contact us today!

Do you have more questions about selling your distressed business? Would you like to know what the market currently looks like for businesses like yours? Ask us! Feel free to leave any questions or comments, we would be happy to help.

Michael Monnot

941.518.7138

Mike@InfinityBusinessBrokers.com

5111 Ocean Boulevard, Suite E

Siesta Key, FL 34242

www.InfinityBusinessBrokers.com

No Comments »

Problems? How Business Buyers Can Spot Issues

Posted in Become a Business Owner, Buyers Articles

If you are looking at businesses to buy, then the first things you will encounter that will tell you about the business are the financial records – likely a P&L and/or tax returns.

While financial records can tell you a great deal about the stability and health of a business – there are some other less obvious ways to determine how a business is really doing.

Watch The Owner

Some owners mentally check out the moment they list their business, some mentally checked out long ago. Owners who are consistently late to meetings, consistently sluggish on answering questions or constantly procrastinating with requested information are probably that way in the day to day operations of their business. A business with an owner who habitually doesn’t stay on top of things probably isn’t in the best shape.

How does the owner treat you when you visit? If they are condescending or rude to a potential buyer – someone who may write them an enormous check in the near future, then they are probably even worse to their employees, vendors and customers.

Read Reviews

You might need to take these with a grain of salt, especially if it is a business with only a handful of reviews. The internet creates a veil of anonymity that some use to blast businesses for almost no slight at all. Some people just love to complain.

What reviews should you take seriously? If a business has 300 reviews and 80% are horrible, then there is definitely an issue. If there are only a few reviews that seem to be written by chronic complainers – but they all follow the same vein, like terrible customer service from wait staff, then that can give you a pretty good idea of what you’ll need to change the moment you get the keys.

Watch For A Mess

When you tour a business, you can find out very quickly if the current owner is someone who excels at attention to detail. A business that is filthy or has equipment in various stages of disrepair is probably lacking ownership attention in other non-physical areas of the business as well.

When you are in the market to buy a business, don’t just rely on the financial numbers when deciding whether to purchase or how much to offer. You can use other indicators, like owner behavior or the state of equipment, to determine if the business is right for the price and for the goals you are hoping to achieve.

If you are looking for a business that is more of a fixer-upper – then bad reviews, poor cleanliness and a disconnected owner might be good signs that you will be able to negotiate for a price that leaves you the capital you’ll need to turn it around. If you are looking for more of a turn-key business, then you’ll want to find the non-financial aspects of the business in good shape.

Do you have questions about other non-financial clues you should be watching for when considering businesses to buy? Do you have one that we didn’t mention that you’d like to share? Please leave your questions and comments – we would be happy to help!

Michael Monnot

941.518.7138

Mike@InfinityBusinessBrokers.com

5111 Ocean Boulevard, Suite E

Siesta Key, FL 34242

www.InfinityBusinessBrokers.com

No Comments »

Why You Absolutely CAN Own Your Own Buisness

Posted in Become a Business Owner, Buyers Articles

When we chat with people and they find out what we do, the conversation usually goes something like this,

“I would love to own my own business, but…(insert excuse here)”

Sure, there are a myriad of reasons why going it alone and owning your own business may seem like a foolhardy venture, but the truth is entrepreneurship can be the key to happiness.

Why? When you own your own business, you are the boss of your day to day life. The amount of money you make, what you do for work – these things are now up to you. Talk to any entrepreneur and they will tell you that this kind of control over your own destiny is absolutely worth it.

Let’s look at some of the big excuses we hear about why buying a business is impossible and show you that all it really takes to be your own boss is a little planning and a lot of drive.

“I don’t have the money.”

Sure, there are a lot of businesses out there that only a multi-millionaire could afford, but the truth is the small business market is full of businesses that many people could absolutely afford to buy. Smaller ventures can be bought outright for cash from your savings, while some medium sized businesses can be purchased with a decent down payment and a bit of seller financing. Think of the money you would need to buy a business this way – you aren’t just spending the money – you are investing it in a business that will give you a return on that investment with some hard work on your part. You already go to a job and work hard for someone else, why not do that for yourself?

“It’s too risky.”

Yes, all business ventures come with their fair share of risk, but so does the job you have now. You could walk into work tomorrow and get fired. If you own your own business, any mistakes you make, any risks you take that don’t pan out will make you a better and smarter entrepreneur in the long run. Think ahead to your retirement. Are you going to look back at your working life, where you gave your blood, sweat and tears to someone else’s business, and wish you had taken the chance to work for yourself?

“I don’t know how to run a business.”

You’re right, none of us did at the beginning – but you learn fast. Think back about every boss you’ve ever had. How many times have you said to yourself “My boss is an idiot, if I were in charge I would…”. See, you do know some of what it takes to own your own business! The rest you can learn along the way. Talk to other business owners, read books, take a class – the know-how is out there if you are willing to find it. It is also a good idea to buy a business in an industry where you’ve already worked. That practical experience will serve you well.

The message here is if you’ve always wanted to own your own business, there is no such thing as an obstacle (or excuse) that you can’t overcome with some hard work and perseverance. Take the entrepreneurial leap, and you can soon be well on your way to business ownership.

Are you thinking about buying a business, but you’re not sure you have enough funds? Are you curious about what would be available? Ask us! Please feel free to leave us a comment or question here, and we would be happy to help you on your journey to entrepreneurship.

Michael Monnot

941.518.7138

Mike@InfinityBusinessBrokers.com

5111 Ocean Boulevard, Suite E

Siesta Key, FL 34242

www.InfinityBusinessBrokers.com

No Comments »

Insights from the Insight Report: Why 2021 Is The Year For Buyers And Sellers

Posted in Buyers Articles, Sellers Articles

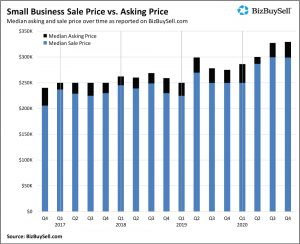

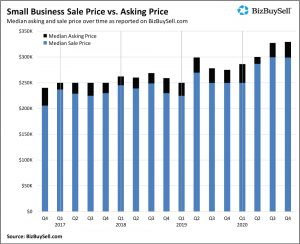

2020 is over and the BizBuySell 2020 Insight Report is out – so what does a look back at an unprecedented year mean for business buyers and sellers in 2021?

Pandemic-proof businesses ruled the year.

2020 was a rough year in the small business marketplace, with a drop of 22% in businesses sold. However, this was not as large of a drop as the market saw during the recession (28% in 2009). Also, businesses sold last year were selling for higher prices than many of the businesses that sold in 2019 (the median sale price for 2020 was up 12% over 2019) as pandemic resistant businesses dominated the market.

“These businesses that continued to perform well despite the pandemic created a golden opportunity for sellers. According to surveyed brokers, 54% of businesses that sold in 2020 were immune to the pandemic, with almost half (24%) thriving.”

The uncertainty created by the pandemic and the shut downs saw many owners pulling their businesses from the market, and those with pandemic-proof business models (think takeout food, delivery service, manufacturing, etc.) enjoying the boom to their bottom line. If you’ve got one of these businesses and were considering selling at some point down the line – now is the time. As vaccine rollouts bring “normal” back, sellers who were on the fence will likely start listing again – in big numbers. Buyers today have far less inventory and inventory with high valuations. Get in while it’s still a seller’s market.

What if your business isn’t in that pandemic-proof category? If your business has suffered, but you’ve managed to persevere – the smart move might be to get your business to a place where you can show growth again before you list. This won’t be the case for every scenario – so talk to with a broker about what the best move will be for you and your business.

What if you’re a buyer? Keep your eye on the prize. Sure, the essential businesses are expensive and hard to come by at the moment – but those businesses are potentially a great buy for the uncertain times ahead. There are also lots of opportunities for buying distressed businesses at a great price. Talk to an experienced broker about what the right path would be for you. A distressed business that can be reinvigorated by adding a delivery option or by the creation of a social media marketing plan could be a good investment if you don’t have the available capital for a pandemic resistant business at the moment.

The message here is although 2020 was a rough year, there is not only a light at the end of the tunnel – the tunnel itself wasn’t as bad as it could have been. Smart business owners have adapted and persevered – and now have the opportunity to get a great return in 2021. If the last year has you reconsidering your life – and you’ve always wanted to own your own business – 2021 could be your year as well. Talk to a qualified business broker about your business ownership goals today!

Do you have more questions about what last year’s numbers mean for you and your business ownership goals? Would you like to know what pandemic resistant businesses are currently for sale? Ask us! Leave any questions or comments and we would be happy to help.

Michael Monnot

941.518.7138

Mike@InfinityBusinessBrokers.com

5111 Ocean Boulevard, Suite E

Siesta Key, FL 34242

www.InfinityBusinessBrokers.com

No Comments »